Table of Content

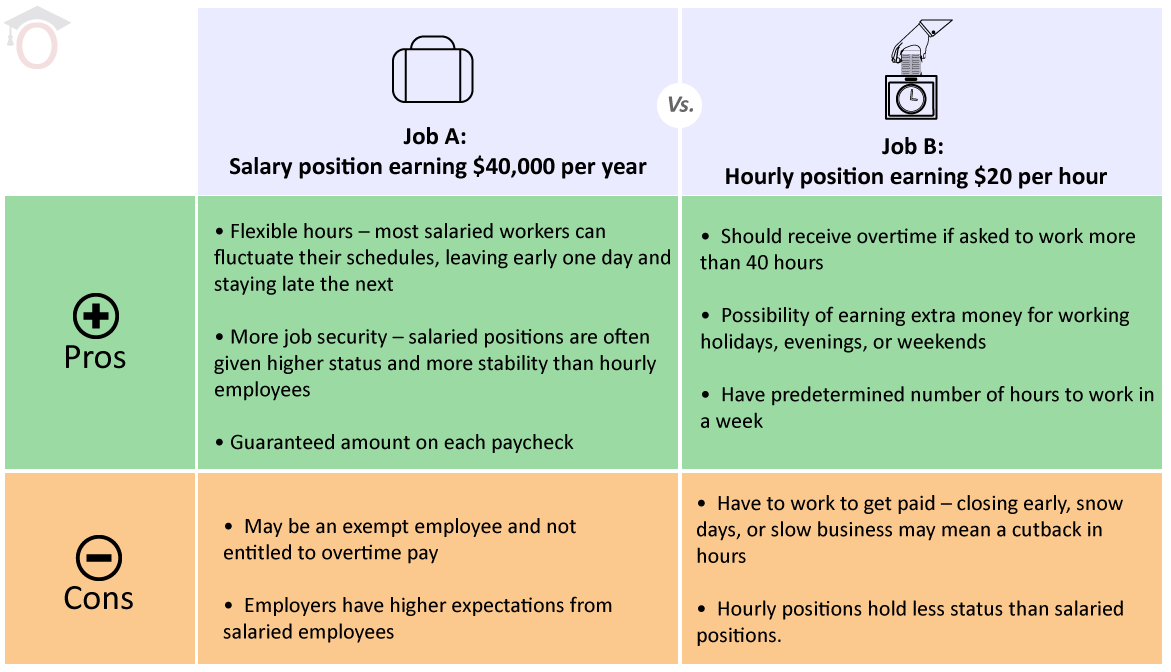

These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year, with no overtime. The money for these accounts comes out of your wages after income tax has already been applied. The reason to use one of these accounts instead of an account taking pre-tax money is that the money in a Roth IRA or Roth 401 grows tax-free and you don’t have to pay income taxes when you withdraw it .

Presbyterian Homes & Services - Lake Minnetonka Shores is seeking a Nutrition & Culinary Supervisor ... Company reviews can provide helpful insights into the company culture, working conditions, benefits, compensation, and training opportunities in Elements At Home. Deductions can lower a person's tax liability by lowering the total taxable income. Company reviews can provide helpful insights into the company culture, working conditions, benefits, compensation, and training opportunities in Caregivers At Home.

What people are saying about At Home

If a company does allow the conversion of unused PTO, accumulated hours and/or days can then be exchanged for a larger paycheck. Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Glassdoor has salaries, wages, tips, bonuses, and hourly pay based upon employee reports and estimates. FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%.

Independent contractors or self-employed individuals pay the full amount because they are both employees and employers. This is one of the reasons why independent contractors tend to be paid more hourly than regular employees for the same job. The average hourly pay rate of Caregivers At Home is $1,344 in the United States. Based on the company location, we can see that the HQ office of Caregivers At Home is in OOLTEWAH, TN. Depending on the location and local economic conditions, Average hourly pay rates may differ considerably. If you're paid an hourly wage of $18 per hour, your annual salary will equate to $37,440, your monthly salary will be $3,120 and your weekly pay will be $720.

Healthcare At Home Job Openings and Hourly Range

How much do Healthcare At Home employees Hourly make in the United States? Healthcare At Home pays an average hourly rate of $584 and hourly wages range from a low of $513 to a high of $668. Individual pay rates will, of course, vary depending on the job, department, location, as well as the individual skills and education of each employee.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. The calculation is based on the 2022 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. Here are some companies in the same or similar industry as Caregivers At Home. Select a company name to explore and learn more about other companies across the industry and to compare their hourly average salaries with Caregivers At Home. Here are some other companies that are located close to Caregivers At Home.

Caregivers At Home Company Jobs and Hourly Pay

Legislation S.9427-A/A.10477 establishes a pay transparency law in New York State, requiring employers to list salary ranges in advertisements or postings for job opportunities and promotions. Department of Labor, women made 83 cents for every dollar made by men in 2020; these disparities are even greater among Black women and Hispanic women . The disclosures required by this law will empower workers with critical information, reduce discriminatory wage-setting and hiring practices, and help level the playing field for all workers. Governor Kathy Hochul today signed legislation (S.9427-A/A.10477) establishing a statewide pay transparency law in New York State, requiring employers to list salary ranges for all advertised jobs and promotions.

The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your company’s 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller.

How Your Paycheck Works: Deductions

If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. The average hourly pay rate of Work At Home is $656 in the United States. Based on the company location, we can see that the HQ office of Work At Home is in CHARLESTOWN, RI. Depending on the location and local economic conditions, Average hourly pay rates may differ considerably. Hourly pay ranges for the same job title may differ based on the location and the responsibilities, skills, experience, and other requirements for a specific job. To search for jobs in other locations, fill in the title and locations to begin your search.

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now. Learn more about Privacy at ADP, including understanding the steps that we’ve taken to protect personal data globally. See how we help organizations like yours with a wider range of payroll and HR options than any other provider.

Access the definitive source for exclusive data-driven insights on today’s working world. Read the latest news, stories, insights and tips to help you ignite the power of your people. Focus on what matters most by outsourcing payroll and HR tasks, or join our PEO. Needs to review the security of your connection before proceeding. I keep getting offers for much more comp to go WFH but I am worried that I will miss the in person interactions and dislike being at home alone everyday. Use our tool to get a personalized report on your market worth.

This is commonly either 52 or 50 weeks, depending on whether you receive paid leave. Your calculated salary figure will be pre-taxation and deductions. If you live in a state or city with income taxes, those taxes will also affect your take-home pay.

About 5,500 Pandit employees have not resumed duty since the killing of Rahul Bhat by militants on May 12 at the Tehsildar’s office in central Kashmir. Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

No comments:

Post a Comment